How Do I Withdraw Money From My Td Ameritrade Account

Chris does online trading during the week; this is one reason he and his family enjoy life and each other. He hopes this helps you.

Understanding the Basics of Lesson Two

Lesson Two of Ameritrade's options course mainly teaches about the terminology of options and how to read your options charts. Many charts start with standard settings; in most digital platforms these are things that you can change to better suit you. but before you start adjusting the variables, make sure that you firmly understand what the variables mean and how they may correlate to each other.

Lesson Two is one of the most basic and important lessons to make sure that you understand options. This is not an area you want to cut corners in, or you will lose money.

Disclaimer

Please do not use this article to cheat, that is, to obtain the options course certificate without understanding the lessons TD Ameritrade presents. Make sure you really understand options trading before you start trading with money. If you don't, you could put yourself in a negative financial situation that could harm you for years to come. If you are new to trading, I would suggest paper trading for a bit before using real money.

Sample Questions from Options Lesson Two

Here are some sample questions from Ameritrade' Options Lesson Two quiz.

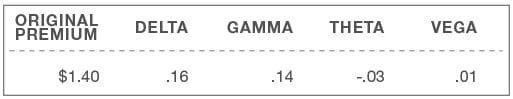

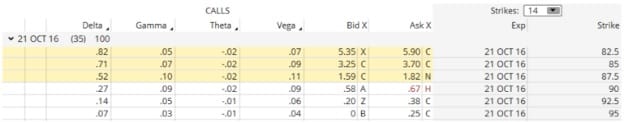

Given this information, if the underlying stock increased by $1 ...

Given this information, if the underlying stock increased by $1 tomorrow, what would the new premium be?

- $1.53 - Correct Answer

- $1.70

- $1.40

- $1.56

By increasing by $1, the delta is added to the original price, $1.40 + 16¢ = $1.56. And since theta has a value then that must be added as well, $1.56 + -.03¢ = $1.53.

Let's say a trader sold a 30 strike ...

Let's say a trader sold a 30 strike put for $2. When he sold it, $0.75 of that premium was extrinsic value. If this option expires OTM, how much intrinsic value does it have at expiration?

- $1.75

- $0.00 - Correct Answer

- $1.25

- $0.75

Intrinsic value for options means the value that is "in the money". Hence, if the option is "out of the money", there is no intrinsic value to it.

If a 62 strike put expires ...

If a 62 strike put expires when the underlying price is at $65, who is likely to profit on the trade?

- Put seller - Correct Answer

- Put buyer

If the the contract expires out of the money, then for a put the seller will profit because they are not obligated to purchase anything and they get to keep the premium.

ATM options

ATM options have extrinsic value at expiration.

- True

- False - Correct Answer

At The Money (ATM) has no value at expiration because they are out of the money.

Which of the following factors ...

Which of the following factors are not relevant at expiration? Select all that apply.

Read More From Toughnickel

- Price of the underlying

- Strike price

- Time - Correct Answer

- Implied volatility - Correct Answer

When all is said and done with a contract, the only two things that matter are was the price of the underlying in the money. And to be in the money, the underlying needs to be under the strike price in a put or the underlying needs to be above the strike price in a call.

If the owner of a long option ...

If the owner of a long option wants to exit the trade, how can he choose to close it? Select all that apply.

- Buy back the option to close the trade

- Sell back the option to close the trade - Correct Answer

- Roll the trade - Correct Answer

- Exercise the option - Correct Answer

Since a long option is a buy, you can't buy a buy back. You can sell a buy, this closes the deal out. You can roll the trade to a different expiration date. Or you could exercise the option and purchase the stocks.

Let's say a trader sold a 71 strike ...

Let's say a trader sold a 71 strike call option on XYZ for $1.50 ($150 total, excluding commissions and fees) when XYZ was trading at $70. XYZ is now trading at $70. How much intrinsic value does this option have?

- $1.00

- $2.00

- $1.50

- $0.00 - Correct Answer

Intrinsic value means how much of it is in the money. For a call option it would be the price of the underlying and subtracting the price of the strike price. $70 - $71 = -1. Which means that it is not in the money, it would be positive if it was. So the intrinsic value is $0.00 in this example.

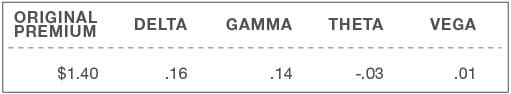

Given this information, if the underlying stock increased by $2 ...

Given this information, if the underlying stock increased by $2 in two days, what would the new premium be?

- $1.40

- $1.64

- $1.67

- $1.80 - Correct Answer

To walk this through we start with our original premium of $1.40 add 16¢ for the first day: $1.40 + 16¢ = $1.56. Then the second day will adjust the delta to ¢16 + 14¢ = 30¢. So we would then have $1.56 + 30¢ = $1.86. That is all the positives, we then have the theta to deal with. Two days of theta would be 2 * -3¢ = -6¢. Combining the positives with the negatives you have $1.86 + -6¢ = $1.80.

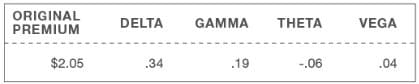

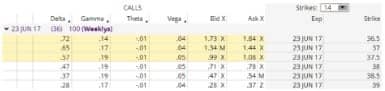

Given this information, what would the new premium ...

Given this information, what would the new premium be if the underlying security increased $1 today?

- $2.33

- $2.05

- $2.39 - Correct Answer

- $2.58

Since this is occuring in the same day and with only $1.00, the premium would only change by delta. So, $2.05 + 34¢ = $2.39.

Let's say you sold a put ...

Let's say you sold a put that expired worthless. Which of these statements best describes the outcome of that trade (excluding commissions and fees)?

- Unprofitable because the premium has evaporated

- Profitable because you were able to keep the premium - Correct Answer

- Unprofitable because you were forced to buy stock at a lower price

- Profitable because you were able to buy stock at a higher price

If you sold a contract either a call or put and it expires worthlessly. This means that there is no obligation or exercise option available and you get to keep the premium. This is often the goal of selling a contract, for it to expire out of the money.

Let's say you sold a call ...

Let's say you sold a call (to open) that expired worthless. Which of these statements best describes the outcome of that trade (excluding commissions and fees)?

- Profitable because you were able to sell stock at a higher price

- Unprofitable because you were forced to sell stock at a lower price

- Profitable because you collected premium - Correct Answer

- Unprofitable because the premium has evaporated

As with the example above, this is good for the seller of the option. Since the contract expired out of the money or worthlessly, the seller keeps the premium and that is the end of this situation.

If you wanted to trade ...

If you wanted to trade the furthest out-of-the-money call, which delta would you choose?

- .50

- .30 - Correct Answer

- .80

- .41

It is assumed that this is the correct answer because it is the smallest delta. The highest delta is the option that is the most in the money and the lowest delta is the furthest out of the money.

Which of the following options ...

Which of the following options has the greatest risk of assignment?

- ITM - Correct Answer

- ATM

- OTM

The highest risk of being assigned or obligated with options is in the money. If the option is in the money it will be exercised or you will be obligated. So selling or purchasing options in the money (ITM) starts you in a position of buying or selling the underlying per the contract.

If you sold a put option with a 50 strike ...

If you sold a put option with a 50 strike, which of the following prices of the underlying stock at expiration would be the most favorable outcome for you?

- $47

- $51 - Correct Answer

- $49

- $48

$51 would mean the contract expired worthlessly and you keep the premium. All other prices would mean that you were obligated to purchase the underlying because with a put the price must be lower than the strike price to be in the money.

If an option has $2 of intrinsic value ...

If an option has $2 of intrinsic value and $1.05 of extrinsic value, what would the options premium be?

- $2.00

- $0.95

- $1.05

- $3.05 - Correct Answer

The option premium is the intrinsic value plus the extrinsic value so $2.00 + $1.05 = $3.05.

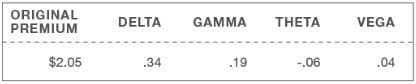

Given this information, what would the new premium be ...

Given this information, what would the new premium be if the underlying security increased $2 within a few hours?

- $2.82

- $2.58

- $2.92 - Correct Answer

- $2.05

By increasing $2.00 in a few hours, we are focusing on the delta and gamma of the option. The delta is the base adjustment and the gamma is the incremental increase. We would have: $2.05 + 34¢ = $2.39 this is the first hour. The second hour we would add the gamma to the delta and then add this into the first hour price. $2.39 + (34¢ + 19¢) = $2.92.

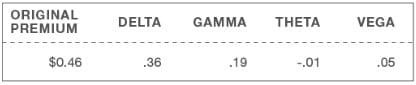

Given this information on a call option ...

Given this information on a call option, if the price of the underlying stock increased by $1 while implied volatility fell 1% tomorrow, what would the new premium be?

- $0.82

- $0.76 - Correct Answer

- $0.81

- $0.86

With a $1.00 increase we will be looking at delta, implied volatility we will look at vega, and being the next day we will look at theta. The equation would be: premium + delta - theta + vega or 46¢ + 36¢ + -5¢ - 1¢ = 76¢. Because implied volatility decreased it turns into a negative number. If implied volatility increased it would stay a positive number.

Let's say a trader bought a 54 strike ...

Let's say a trader bought a 54 strike call option on XYZ for $2 ($200 total, not including commissions and fees) when XYZ was trading at $53. XYZ is now trading at $55.50. How much intrinsic value does this option have?

- $1.00

- $1.50 - Correct Answer

- $2.00

- $2.50

Intrinsic value is the amount of the underlying that is in the money. So, subtract the strike price from the underlying price and if the difference is positive then it is the intrinsic value. In this case, $55.50 - $54 = $1.50. If the difference is negative it is out of the money and therefor not intrinsic.

Let's say XYZ is currently trading at $78 ...

Let's say XYZ is currently trading at $78. If you wanted to sell an out-of-the-money call, what strike would you choose?

- 76

- 78

- 80 - Correct Answer

With a call the price of the underlying needs to be above the strike price. With this example we are looking for a price that is above the current price of $78. $76 is in the money, $78 is at the money, and $80 is out of the money.

An option has 30 days to expiration ...

An option has 30 days to expiration. Does the option have extrinsic value?

- No

- Yes - Correct Answer

An option has extrinsic value until it is expired. Since the option is still open, it has extrinsic value.

Let's say XYZ is currently trading at $31 ...

Let's say XYZ is currently trading at $31. If you wanted to purchase an out-of-the-money call, what strike would you choose?

- 32 - Correct Answer

- 31

- 30

With a call option, the underlying price needs to be above the strike price to be in the money or the underlying needs to be lower than the strike price to be out of the money. In this case, the question is asking what strike price is higher than the underlying XYZ of $31. The answer would be $32 strike price puts $31 underlying out of the money.

$30 strike price would be in the money, since $31 underlying value is higher than the $30 strike price. And $31 strike price is at the money with a $31 underlying trade price.

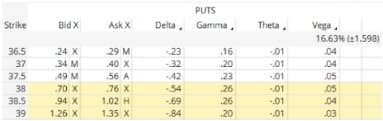

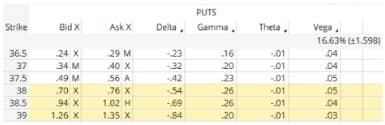

A trader wants to sell a put ...

A trader wants to sell a put with the highest likelihood of expiring out of the money. Which strike should she select?

- 37.5

- 39

- 36.5 - Correct Answer

- 38.5

Which theta would be ...

Which theta would be more desirable for a buyer?

- -.04 - Correct Answer

- -.14

- -.10

- -.08

Let's say XYZ is currently trading at $23 ...

Let's say XYZ is currently trading at $23. If you wanted to sell a put with intrinsic value, what strike price would you choose?

- $23

- $25 - Correct Answer

- $21

Which statement best describes the rights or obligations ...

Which statement best describes the rights or obligations of a call option seller before expiration?

- The seller has the right to sell the underlying.

- The seller is obligated to buy the underlying if the option is assigned.

- The seller is obligated to sell the underlying if the option is assigned. - Correct Answer

- The seller has the right to buy the underlying.

Let's say XYZ is currently trading at $110 ...

Let's say XYZ is currently trading at $110. If you wanted to buy a put with intrinsic value, what strike price would you choose?

- $111 - Correct Answer

- $109

- $110

Which positions can be exercised ...

Which positions can be exercised by the holder? Select all that apply.

- Long puts - Correct Answer

- Short calls

- Long calls - Correct Answer

- Short puts

A trader wants to sell ...

A trader wants to sell a call with the lowest likelihood of expiring in the money. Which strike should she select?

- 39 - Correct Answer

- 36.5

- 38.5

- 37.5

Let's say XYZ is currently trading at $45 ...

Let's say XYZ is currently trading at $45. If you wanted to sell an at-the-money put, what strike would you choose?

- 43

- 45 - Correct Answer

- 47

A buyer must exercise ...

A buyer must exercise his option to close the trade.

- True

- False - Correct Answer

If you wanted to trade an in-the-money put ...

If you wanted to trade an in-the-money put, which delta would you choose?

- -.41

- -.50

- -.80 - Correct Answer

- -.03

If a 62 strike put expires when the underlying ...

If a 62 strike put expires when the underlying price is at $65, who is likely to profit on the trade?

- Put seller - Correct Answer

- Put buyer

Which options delta ...

Which options delta would indicate that the option was in the money?

- .50

- .41

- .03

- .80 - Correct Answer

If you wanted to trade ...

If you wanted to trade an at-the-money put, which delta would you choose?

- -.50 - Correct Answer

- -.80

- -.03

- -.41

Which of the following ...

Which of the following are true of the bid/ask spread? Select all that apply.

- It narrows as liquidity increases. - Correct Answer

- It's the cost of market makers' services. - Correct Answer

- It's a maintenance fee for trading platforms.

- It widens as liquidity increases.

You have a short put position ...

You have a short put position with a 63 strike. At which of these stock prices would you likely be assigned at expiration? Select all that apply.

- $63.25

- $61.00 - Correct Answer

- $64.00

- $62.50 - Correct Answer

If a 112 strike put expires when the underlying ...

If a 112 strike put expires when the underlying price is at $109, who benefits from the trade?

- Put buyer - Correct Answer

- Put seller

Let's say a trader bought a 35 strike put option ...

Let's say a trader bought a 35 strike put option on XYZ for $0.75 ($75 total, excluding commissions and fees) when XYZ was trading at $37. XYZ is now trading at $36. How much intrinsic value does this option have?

- $2.00

- $0.75

- $0.00 - Correct Answer

- $1.00

A trader wants to buy a put ...

A trader wants to buy a put with the lowest likelihood of expiring out of the money. Which strike should he select?

- 37.5

- 39 - Correct Answer

- 36.5

- 38.5

Which of the following statements ...

Which of the following statements is true about time value?

- Time value only erodes on days that the market is open.

- Time value decays faster as an option gets closer to expiration. - Correct Answer

- Options with many months to expiration have little time value.

A trader wants to sell a call ...

A trader wants to sell a call with the lowest likelihood of expiring in the money. Which strike should he select?

- 82.5

- 95 - Correct Answer

- 87.5

- 90

Which of the following factors directly impact an options premium ...

Which of the following factors directly impact an options premium? Select all that apply.

- Implied volatility - Correct Answer

- Price of the underlying - Correct Answer

- Time - Correct Answer

- News

The Next Quiz

TD Ameritrade's quiz three goes over basic trading strategies and understanding how to read how much risk is involved with an option. If you are interested in learning about the quiz please read Trading Options: TD Ameritrade Options Quiz Three of Six.

This content is accurate and true to the best of the author's knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2019 Chris Andrews

Scott Belford from Keystone Heights, FL on September 22, 2019:

EXCELLENT!!!

How Do I Withdraw Money From My Td Ameritrade Account

Source: https://toughnickel.com/personal-finance/TD-Ameritrade-Trading-Options-Quiz-Two-of-Six

Posted by: jacksonvoll1986.blogspot.com

0 Response to "How Do I Withdraw Money From My Td Ameritrade Account"

Post a Comment